After an Explosive Year for Israeli Venture – Where is the Ecosystem Headed?

Earlier this month we had the privilege of hosting a power-house panel of leading global investors to discuss the booming Israeli start-up ecosystem and where it’s headed.

We were left with a lot of fascinating food for thought and wanted to share with you our favorite takeaways. A big thank you to Adam Valkin of General Catalyst, Philippe Bottieri of Accel and Yifat Oron of Blackstone for sharing your wisdom with us!

Talent Talent Talent

From our discussion, it’s clear that the driving force behind the major growth is the outstanding entrepreneurs who have the experience and desire to swing for the fences. Whether it’s the large pool of second-time entrepreneurs, the graduates of the elite military units taking their knowledge to the private sector or the seasoned technologists who put in the time at leading multinational corporations, the breadth and depth of this talent pool is putting the Israeli ecosystem ahead of the pack.

These entrepreneurs have always wanted to make a global impact and leave behind a legacy. In the past, they did not have the opportunity to make it on their own and therefore often chose the path of being acquired by a large corporation that could bring their “dream” to the market. Today, the availability of growth financing enables them to take their destiny into their own hands, deliver their dream to the market and remain independent.

Mega-rounds = Mega expansion

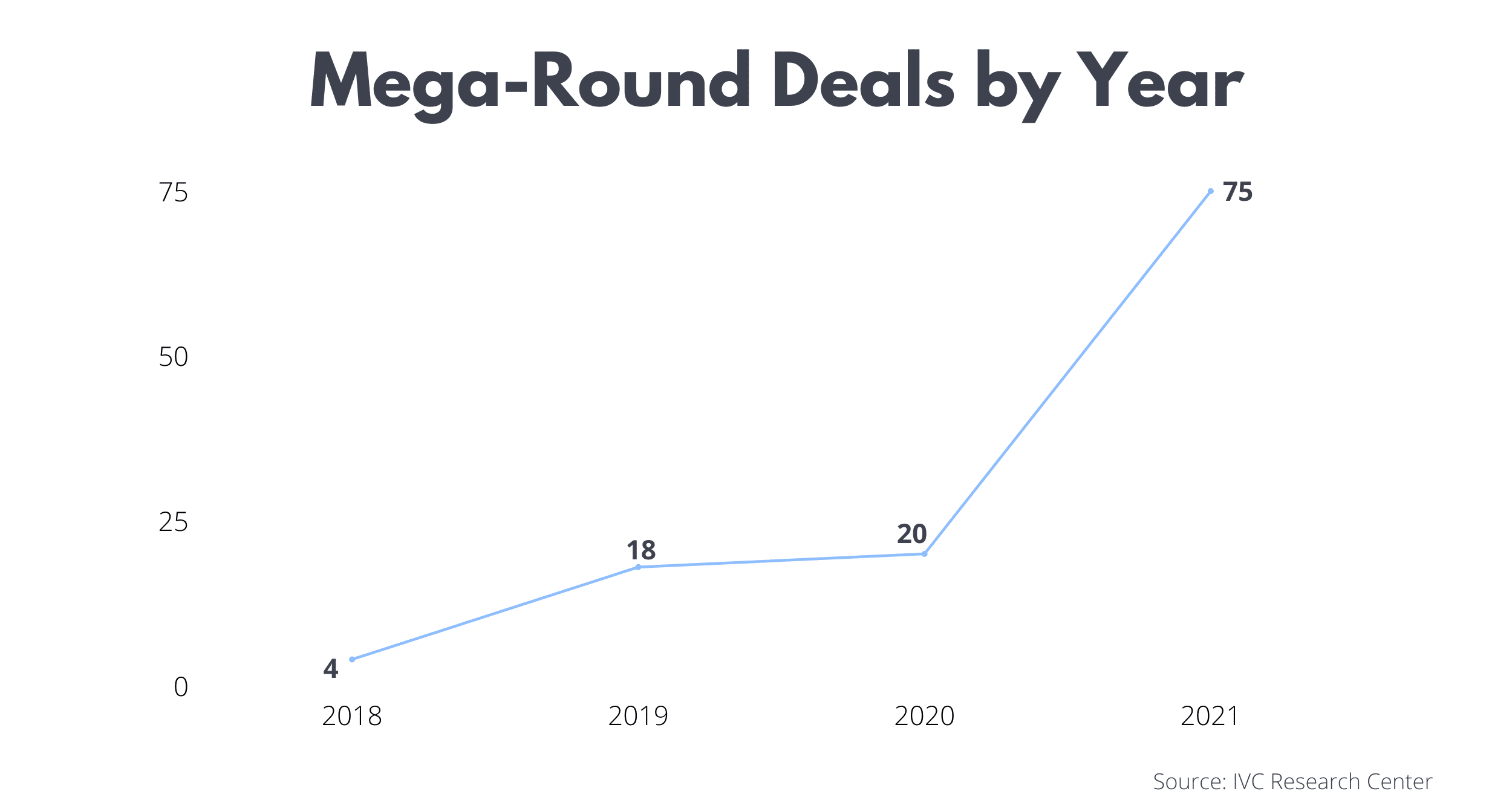

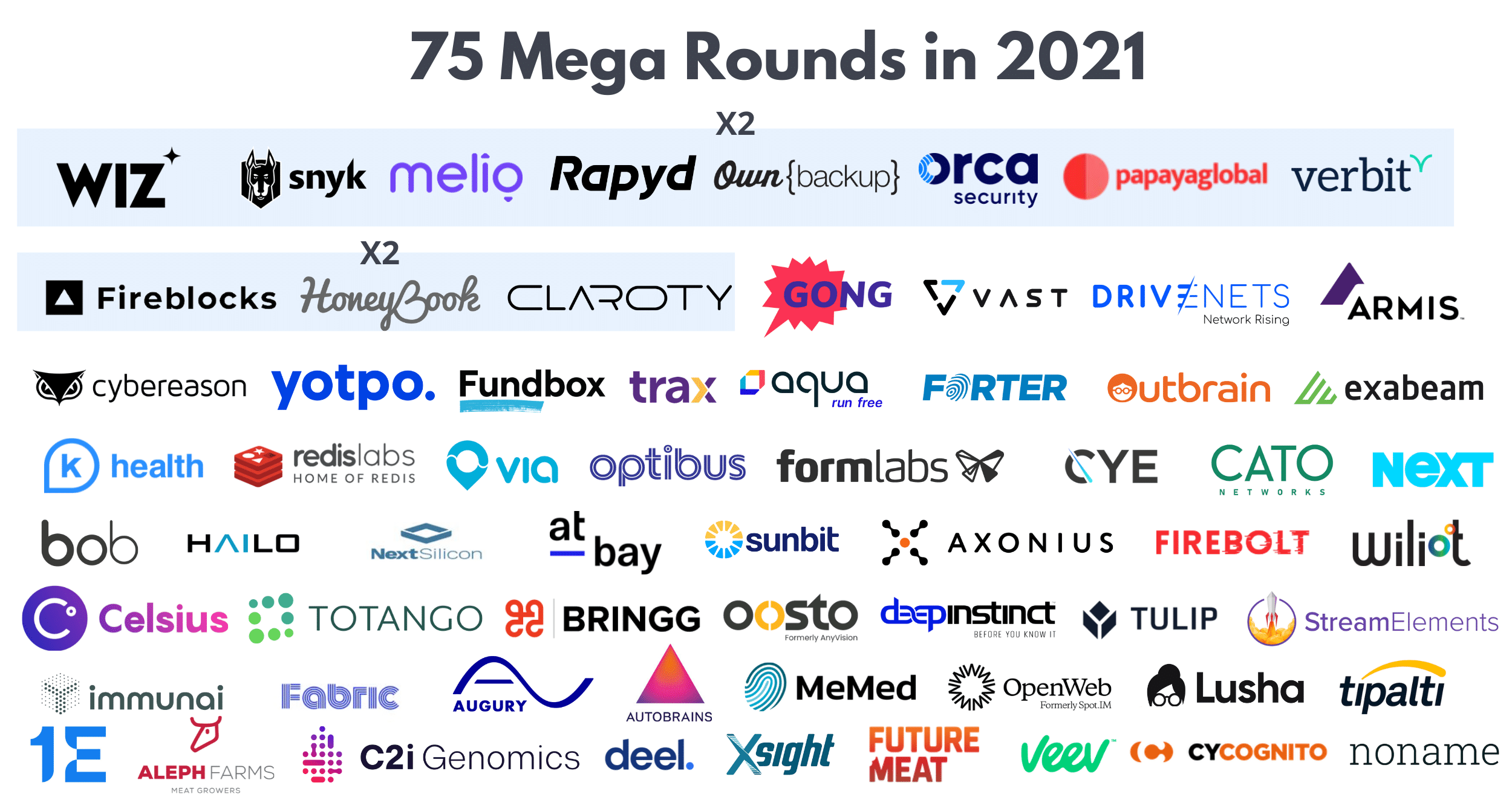

Across the board this year there has been an increase in fundraising, unicorn growth rate and exits – however, most striking is the number of mega-rounds ($100M deals). According to our research, there have been 75 mega-rounds completed – an increase of 3.75X over 2020.

We’ve also witnessed nearly a dozen companies raising multiple mega-rounds including Wiz, Snyk, Melio, Ownbackup, Rapyd, Orca, Fireblocks, PapayaGlobal, Honeybook, Claroty and Verbit to reach multi-billion-dollar valuations. These mega-deals also ushered in a new set of major growth investors into the ecosystem such as Tiger Global, Coatue, Insight Partners, Blackstone and many more who have been widening their footprint in Israel.

With the major influx of hundreds of millions of dollars on their balance sheets – the companies are deploying the capital to tackle a much wider addressable market at a faster speed. This includes a relatively recent phenomenon of Israeli firms buying other Israeli firms. According to Start-Up Nation Central, there were 39 such deals – the highest number to date, up from 21 in 2020. The acquisitions enable these companies to enter new geographies, buy customers and complete their product roadmaps.

The Covid Effect & the New Rules of the Game

It goes without saying that Covid has ushered in a new digital era, with organizations across all fields understanding the importance of shifting online. It’s also left its footprint on the way deals are done in the earliest stages of venture. Covid leveled the playing field – taking what once was essentially a local business to the global scale. Entrepreneurs raising capital are now able to access a much wider range of investors without the logistical hassle of having to cross an ocean. As a result, competition has greatly increased, pushing valuations and round sizes up while shortening the time it takes for deals to close.

Israeli companies have always had the handicap of being distant from their main markets and over the years have developed remote skills to overcome this. In Israel, the remote capabilities brought to the forefront by the pandemic have succeeded to “flatten the world” and have created a long-term competitive advantage for the Israeli tech ecosystem, reducing the distance that there was in the past.

In addition, this pandemic period has proved that relocating management to the US, an age-old practice for leading technology start-ups is no longer a necessity. Many of the best companies in the world are now being founded and headquartered in Israel further boosting the local tech ecosystem.

What’s Next?

None of our panelists can see into the future (or so they say) but the consensus is that short of a global downturn this is just the beginning of the growth revolution in Israel. Israel has all the ingredients necessary to lead the next wave of global technology giants in industries undergoing major disruption including fintech, digital health and more.